Ever wondered if your financial advisor is more of a wizard than a numbers cruncher? In today’s world, their magic wand is digital marketing! As we dive into online strategies, we must recognize the power of a well-crafted digital presence. Understanding and implementing effective digital marketing strategies becomes paramount for financial advisors in a landscape where clicks and likes are as valuable as gold coins in a treasure chest. And here’s a fun fact: Plerdy, the wizard behind the curtain, ensures your digital marketing spells are cast correctly. So, let’s embark on this journey to transform your digital footprint from a hidden treasure map to a shining beacon in the financial advisory world.

Navigating the Digital Seas of Marketing for Financial Advisors

Envision the digital world as a vast sea, where your financial advisory firm is a vessel embarking on a journey. To navigate these waters effectively and reach destinations of prosperity, a profound comprehension of your digital marketing environment is essential.

The digital domain for financial advisors is expansive and continuously evolving. It includes aspects ranging from the user experience on your website to your engagement on social media platforms. Recognizing how these components work together to form your online persona is the initial stride toward excelling in digital marketing for financial advisors.

Identifying Your Virtual Audience

Every financial advisor must pinpoint their virtual audience accurately. Are they digitally adept younger individuals or traditionally inclined senior investors? Understanding their online behaviors, preferences, and financial aspirations is key to shaping your digital marketing approach. For instance, a younger demographic might find more value in interactive financial planning tools or educational social media posts. A firm understanding of your audience is the cornerstone of your digital marketing initiatives for financial advisors.

Examining Competitors’ Digital

Approaches Analyzing your competitors’ digital strategies isn’t about copying but innovating. What digital platforms are they utilizing effectively? How does their content approach differ from yours? Conducting a competitive analysis aids in spotting weaknesses in your strategy and discovering unique marketing opportunities. Tools like SEMrush can provide insights into competitors’ web traffic, key phrases, and online performance, offering valuable benchmarks for your digital marketing strategy as a financial advisor.

Comprehending your digital landscape involves an in-depth assessment of your target audience and rivals. It’s about developing a distinctive digital presence that resonates with your intended market while maintaining an edge over your competitors. This fundamental step is vital for financial advisors seeking to make a substantial mark in digital marketing.

Crafting Your Digital Marketing Strategy

Like a master chef blends unique ingredients to create a signature dish, crafting your digital marketing strategy involves combining various elements to achieve success. This process is not just about being present online; it’s about being impactful.

A good digital marketing plan supports your business goals and targets your audience. It’s a roadmap that guides every post, email, and campaign, ensuring they contribute to your overall business objectives.

Setting Achievable Goals

Start by setting clear, achievable goals. Use the SMART goal framework to increase brand awareness, leads, and client engagement. Consider increasing website traffic by 20% in six months or email list growth by 30% in a year. These specific goals will direct your efforts and help measure success.

Choosing the Right Channels

Not all digital channels are equal for every target audience. LinkedIn might be more effective than Instagram if your clients are primarily professionals. Analyze where your target audience spends online and focus your efforts there. Google Analytics can reveal which channels reach and engage your audience best.

Remember that a successful digital marketing strategy for financial advisors blends clear goals and the right channels. It’s about harmonizing each element to achieve your overall business objectives. This strategic approach ensures that your digital marketing efforts are active, effective, and result-oriented.

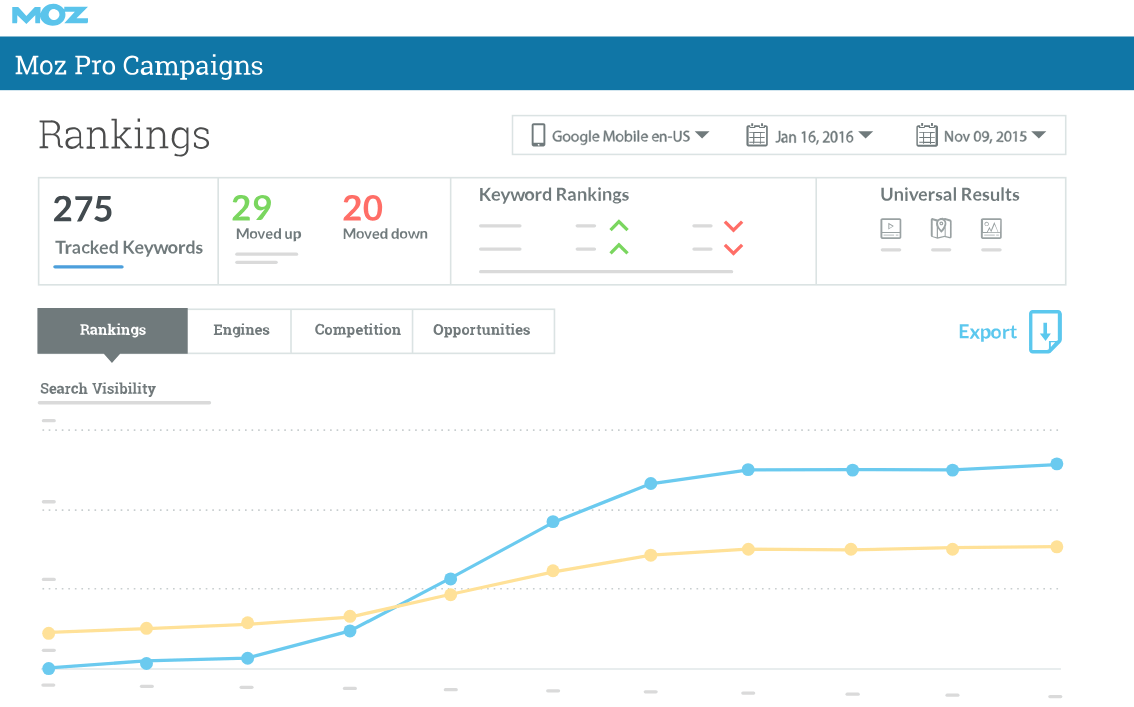

Maximizing SEO for Higher Visibility

In digital marketing, SEO is like the beacon that guides ships to your harbor. It’s not just about being online; it’s about being found. For financial advisors, maximizing SEO means ensuring your website and content are visible and prominent in search engine results.

SEO for financial advisors isn’t just about stuffing keywords; it’s about creating content that resonates with your audience and search engines. Research the keywords and phrases your potential clients use when seeking financial advice. Tools like Moz or SEMrush can offer insights into the most effective keywords in your industry.

Implementing SEO Best Practices

Implementing SEO best practices involves optimizing your website’s structure, improving loading speeds, and ensuring mobile responsiveness. Content-wise, it means regularly updating your blog with informative articles that include those targeted keywords. Remember, quality trumps quantity. Each piece of content should provide value to your readers, addressing their needs and questions. Also, remember backlinks – having reputable websites link back to your site boosts your credibility in the eyes of search engines.

SEO requires continual analysis and strategy adjustments based on performance data. Financial advisers can maximize their online presence by following SEO trends and best practices.

Leveraging Content Marketing

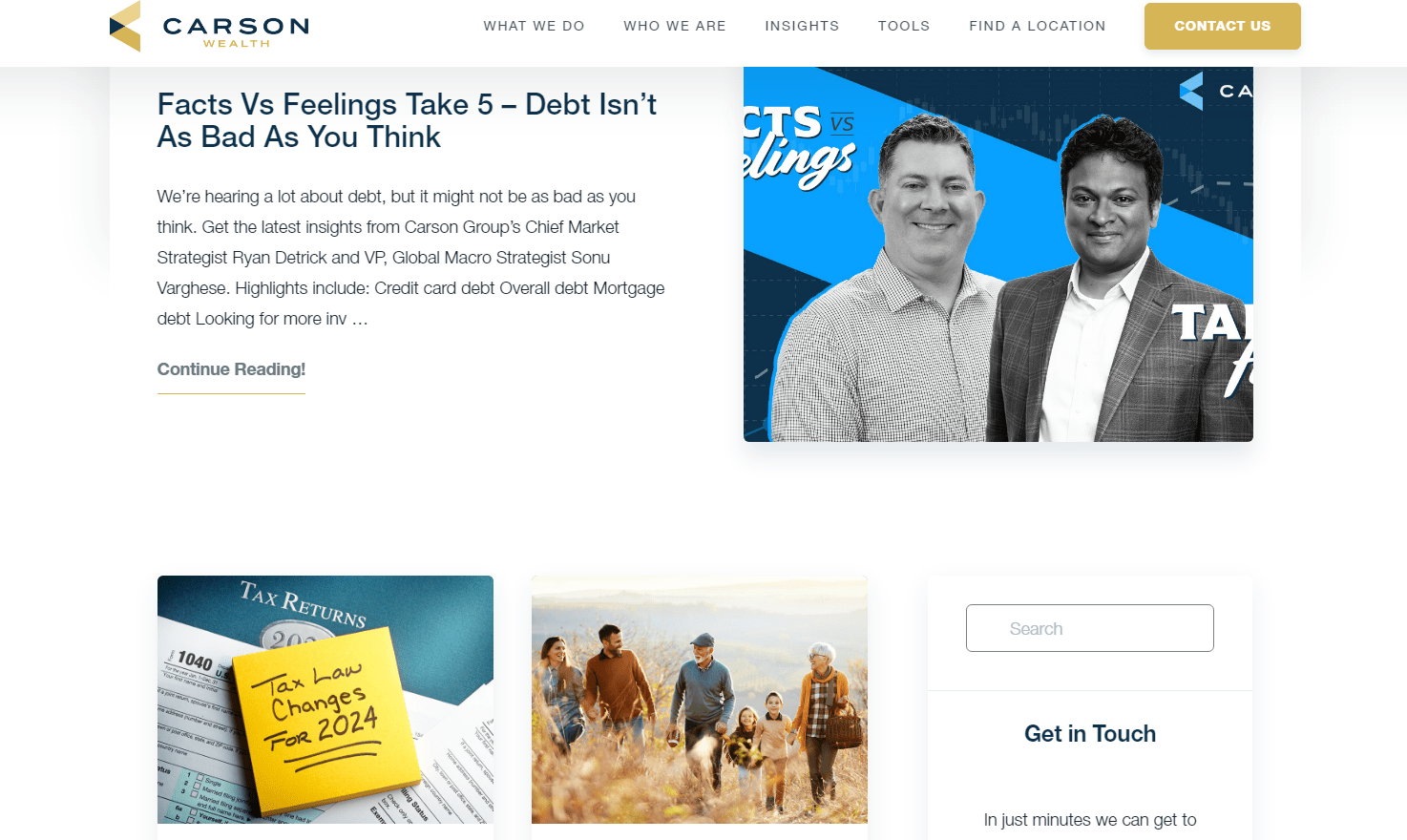

In the digital world, content is king. For financial advisors, leveraging content marketing is akin to engaging with your audience. It’s not just about broadcasting your services; it’s about sharing insights, stories, and information that add value to your clients’ lives.

Effective content marketing for financial advisors involves more than just writing articles. Your audience will respond to insightful blogs, in-depth guides, interesting films, and infographics. Each piece should be crafted with your audience in mind, addressing their concerns, interests, and questions.

Creating Engaging Content

The key to engaging content is knowing what your audience wants. Dive into topics that matter to them, like retirement planning, investment strategies, or financial wellness tips. Use storytelling to make complex financial topics relatable and understandable. Use examples and case studies to support your claims. Education and engagement are the goals, not simply sales.

Content marketing is powerful for financial advisers but requires strategy. Creating diverse, engaging, and informative content allows you to establish yourself as a thought leader and build stronger connections with your audience. Remember that content quality mirrors service quality.

Effective Email Marketing Techniques

In digital marketing, email stands as a timeless pillar, robust against the ever-shifting online world trends. For financial advisors, mastering effective email marketing techniques is akin to unlocking a direct line of communication with clients and prospects. It’s personal, direct, and, when done right, incredibly effective.

Understanding your target and providing valuable content is key to a successful email campaign. Your emails should be more than just updates; they should offer insights, advice, or exclusive opportunities that speak directly to your client’s financial interests and needs.

Building Your Email List

Any email marketing campaign needs a large, engaged email list. Start by integrating sign-up forms on your website and social media pages. Offer incentives, like free financial guides or market analysis reports, to encourage subscriptions. Make signup easy. Remember, a quality list is more beneficial than a larger, less engaged audience.

Effective email marketing for financial advisors hinges on a targeted approach that values quality over quantity. It’s about building relationships and trust, one email at a time. Offer valuable, relevant content to transform your email list into a great client engagement and retention tool.

Utilizing Social Media Platforms

In today’s digital era, social media is the town square where conversations happen, opinions are formed, and brands get noticed. Financial advisors should use social media to engage with their audience and shape their online persona.

Successful social media use requires understanding each platform’s dynamics. LinkedIn, for instance, is ideal for professional networking and sharing in-depth articles. At the same time, platforms like Facebook and Instagram are great for building brand personality and engaging with clients on a more personal level.

Best Practices for Social Media

Focus on consistency, relevance, and:

- Focusing on maximizing your social media impact.

- Hare content regularly, but ensure it’s valuable and pertinent to your audience.

- Respond to followers’ comments and join pertinent discussions.

- Utilize multimedia content like videos and infographics to make your posts more engaging.

Your social media presence represents your brand, so be professional, friendly, and knowledgeable.

Effectively utilizing social media platforms is about balancing professional insights and personal engagement. Financial advisers may develop a strong online presence that resonates with their audience and builds digital trust by following these best practices.

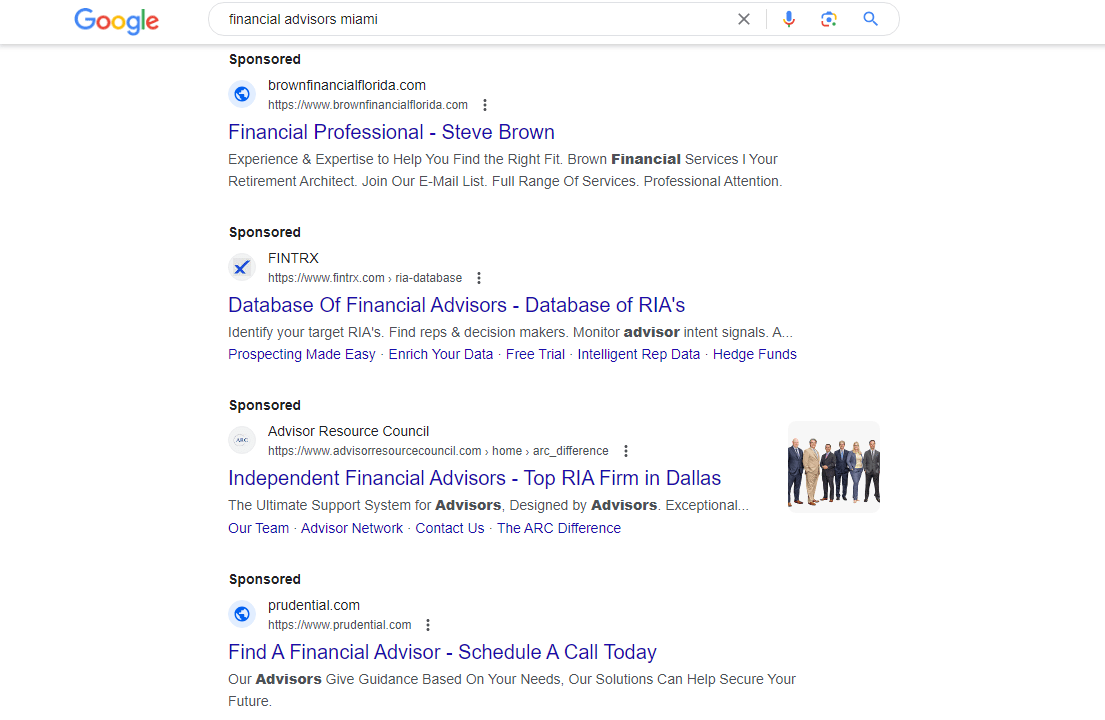

Pay-Per-Click Advertising

Pay-per-click (PPC) advertising is like a sniper rifle – precise, targeted, and effective in the digital marketing toolkit. For financial advisors, PPC offers a unique opportunity to place their services directly in front of potential clients when they are searching for financial advice.

PPC advertising involves developing and putting ads on Google and Bing, where you pay per click. It’s a way to ‘jump the queue’ on search engines and gain immediate visibility. To make the most of PPC, targeting your ads effectively is crucial. This means selecting the right keywords, crafting compelling ad copy, and directing click-throughs to a relevant, engaging landing page.

Crafting Effective PPC Ads

Creating successful PPC ads requires a combination of compelling copy and strategic keyword selection. Your succinct, effective ad language should highlight the distinctive benefits of your financial services. Utilize keywords that your target audience will likely use when searching for financial advice. Tools like Google Ads Keyword Planner can help identify high-performing keywords. Remember, the goal is to make your ad stand out and entice potential clients to click through to your website.

PPC advertising can be a powerful component of a financial advisor’s digital marketing strategy. When done right, it drives targeted traffic to your website, raising conversion rates. Balancing cost with effectiveness, PPC demands careful planning but offers substantial rewards regarding visibility and client acquisition.

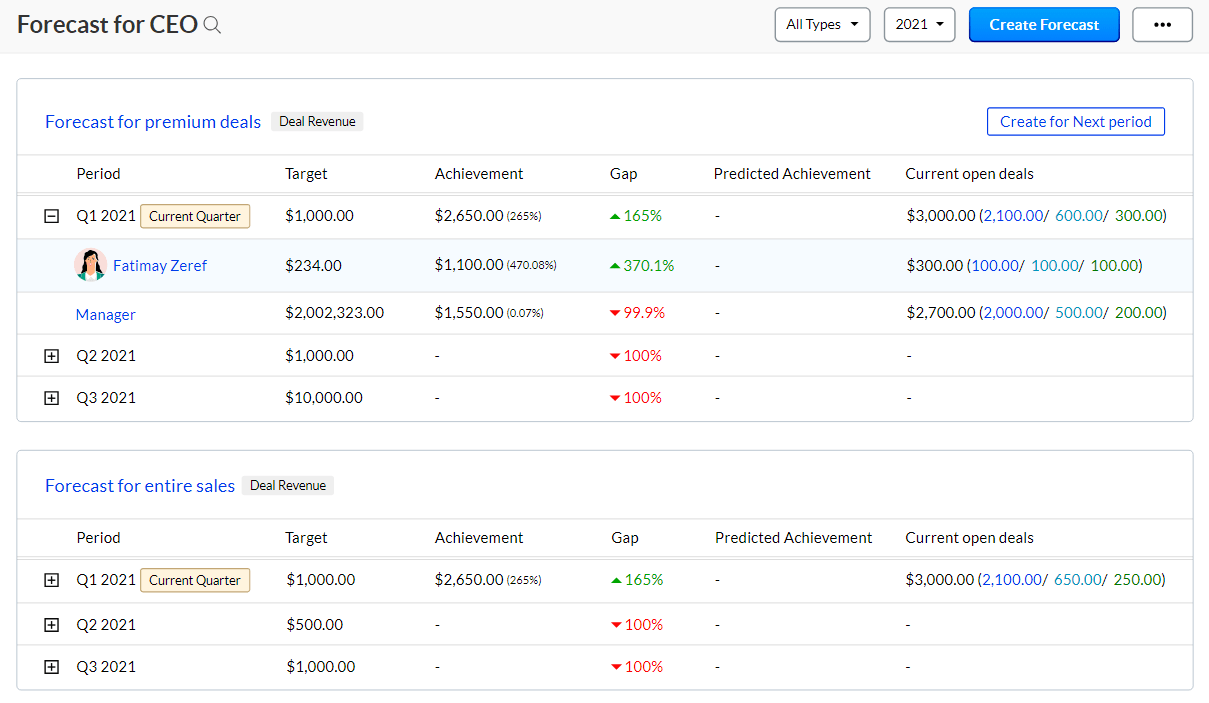

Enhancing Lead Nurturing and Conversion in Digital Marketing for Financial Advisors

In digital marketing, leads are like seeds requiring careful nurturing to flourish into rewarding client relationships. For financial advisors, mastering the art of lead nurturing and conversion is a delicate mix of timely communication, personalized engagement, and ongoing value delivery.

Effective lead nurturing in financial marketing is about forging a relationship with potential clients from their initial interaction with your brand. It involves understanding their needs, supplying them with relevant information, and guiding them towards a decision. Tools like CRM software are crucial for financial advisors to track interactions and customize follow-ups.

Strategies for Lead Nurturing in Financial Marketing

Successful lead nurturing for financial advisors entails regular, targeted communication that caters to potential clients’ specific interests and concerns. This might include personalized emails, informative newsletters, or timely follow-ups. Each interaction should add value, such as sharing a relevant article, inviting you to a webinar, or offering a market update. The goal for financial advisors is to remain prominent in the client’s mind without being intrusive.

Nurturing leads is a vital component in the conversion process for financial advisors. It’s about more than just selling; it’s about building trust and demonstrating value as a financial advisor. By effectively nurturing leads, financial advisors enhance the likelihood of converting prospects into loyal clients, fostering sustainable business growth in digital marketing.

Harnessing the Power of Video Marketing

In the digital age, video marketing is like a spotlight on a stage, drawing your audience’s attention and holding it. For financial advisors, it’s a dynamic tool that brings financial concepts to life and humanizes their services. Video marketing can set you apart, making complex financial topics more accessible and engaging to your audience.

Video marketing offers a range of possibilities, from explaining financial concepts through animated videos to sharing client testimonials and insights into market trends. These videos can significantly enhance your digital presence, making your content more shareable and engaging.

Creating Engaging Video Content

Creating engaging video content starts with understanding what your audience finds valuable. Address common financial questions or concerns in your videos. Incorporate real-life scenarios to illustrate how your services can impact their financial well-being. Keep the videos concise, informative, and visually appealing. Remember to inform, engage, and connect with your audience.

Video marketing is a powerful medium that, when used effectively, can transform your digital marketing strategy. Video helps educate, engage, and build trust with your audience, making your online presence more dynamic and captivating.

Implementing Referral Marketing Strategies

In the world of financial advising, a strong referral is like gold. It’s a testament to the trust and satisfaction of your existing clients, and it opens doors to new opportunities. Referral marketing can help you grow your clientele using current client networks.

Creating a successful referral program involves encouraging satisfied clients to recommend your services to others. It’s about making referring as easy and rewarding as possible for them. Remember, the most persuasive marketing is the endorsement of a satisfied client.

Encouraging Client Referrals

To encourage client referrals, start by delivering exceptional service that clients naturally want to discuss. You can then introduce a referral program, offering incentives for each successful referral. This could be a discount on future services, a small gift, or recognition in your communications. Ensure your clients know the program and how they can participate. Personalized thank-you messages for referrals can enhance client relationships and encourage ongoing advocacy.

A well-implemented referral marketing strategy can be a significant growth driver for financial advisors. By creating a system that rewards and acknowledges your clients for their referrals, you expand your client base and strengthen existing client relationships, fostering a community of loyal and engaged clients.

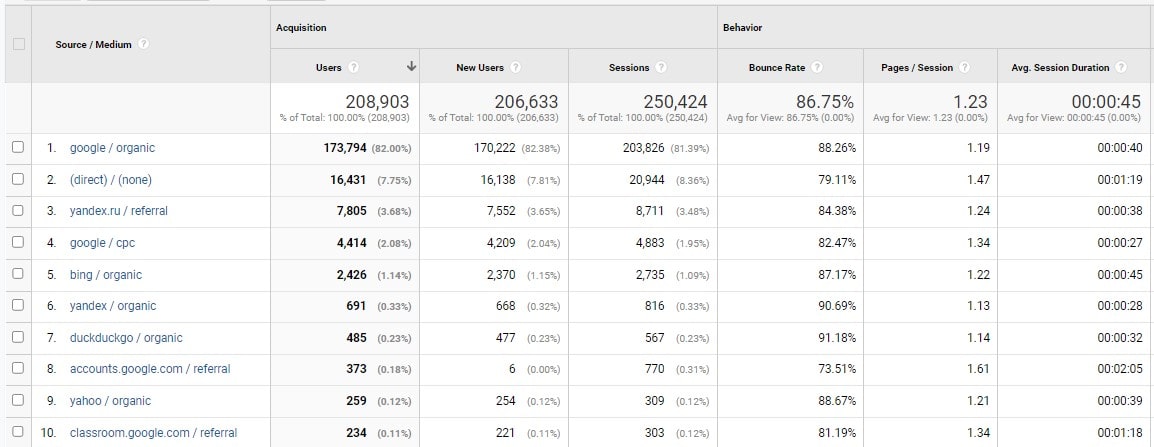

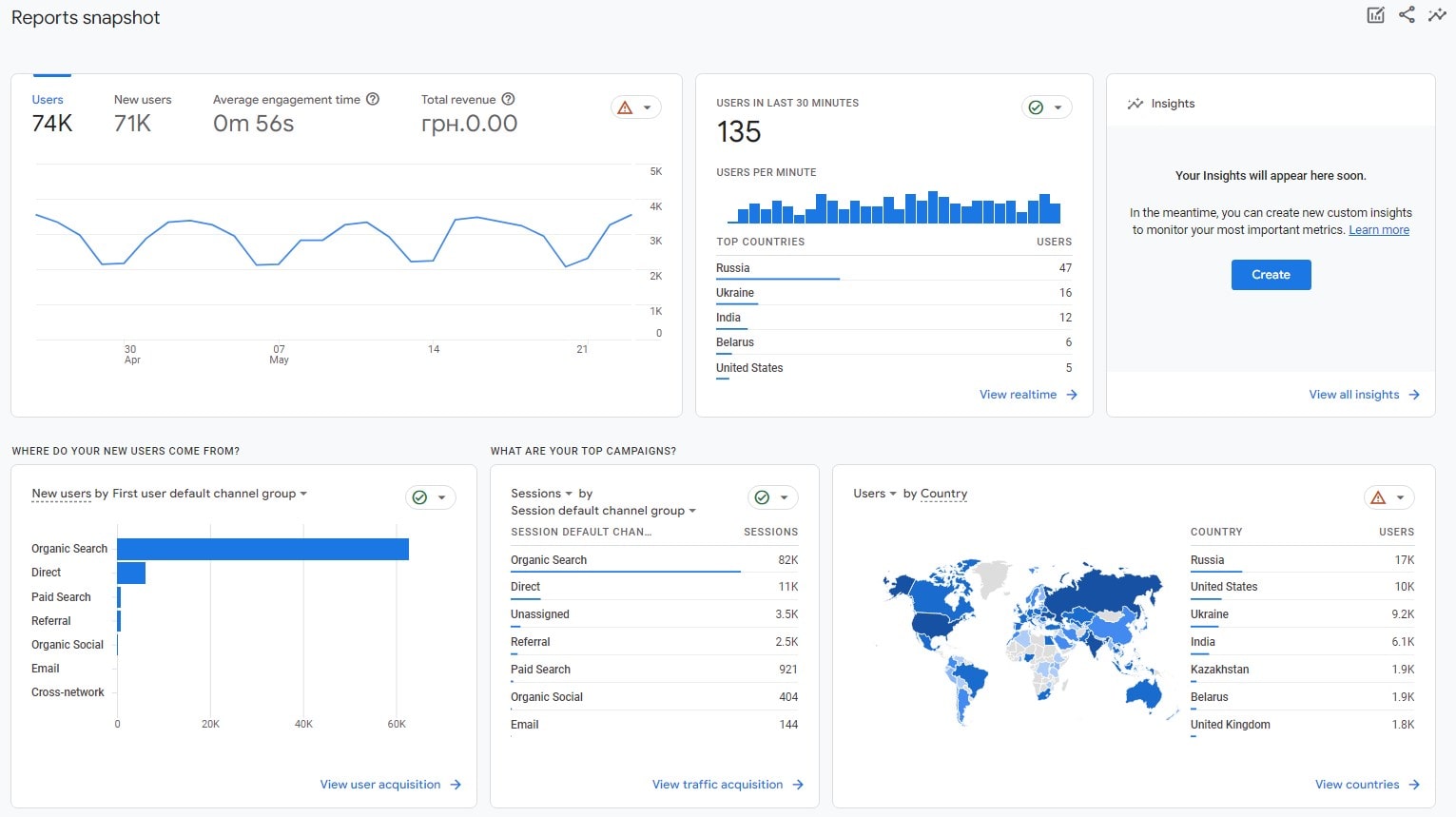

Monitoring and Analytics

Monitoring and analytics are your compass and map in the digital marketing journey. They guide your strategy, showing you where you’re succeeding and where you need to recalibrate. Financial advisers must analyze website traffic, user activity, and conversion rates to assess marketing performance and make data-driven recommendations. Tools like Google Analytics offer valuable insights into website traffic, user behavior, and conversion rates. Regularly reviewing these metrics helps identify trends and audience behavior.

Key Performance Indicators (KPIs)

Focus on marketing-related KPIs. These include website traffic, lead generation rates, conversion rates, and social media engagement. Tracking these KPIs will show you what works and what does not, helping you improve your plan. Data should be collected and used to make marketing decisions.

Effectively utilizing monitoring and analytics is crucial for the success of any digital marketing strategy. By regularly tracking and analyzing key metrics, financial advisors can refine their marketing efforts, ensuring they are targeting the right audience with the right message and ultimately driving growth and success in their digital marketing endeavors.

Conclusion

In the digital age, financial advisors must navigate the vast seas of online marketing with skill and precision. The strategies outlined in this article are your compass, guiding you to connect with clients and grow your business effectively. Remember, digital marketing is an ever-evolving landscape demanding continuous learning and adaptation. If this journey excites you, explore more insights and strategies on Plerdy’s blog, where the world of digital marketing is constantly unraveled. For a practical solution to track your success and refine your strategies, consider Plerdy’s analytics tools – your partner in navigating the digital marketing waters and unlocking your firm’s potential.