Imagine walking into a bank only to find the tellers are robots, and the ATMs are giving financial advice. This sounds like a sci-fi movie, but this is 2024 financial services digital marketing. The industry has rapidly evolved from traditional face-to-face interactions to dynamic, digital engagements. As we delve deeper into this transformation, it’s crucial to recognize the role of innovative tools like Plerdy in enhancing user experience and conversion rates on financial platforms. Our journey through this digital revolution promises insights into strategies reshaping the financial world.

Embracing Omnichannel Marketing Strategies

In today’s digital age, if financial services aren’t everywhere their customers are, they might as well be nowhere. Embracing omnichannel marketing strategies isn’t just a trend; it’s a necessity for staying afloat and relevant in the rapidly evolving financial landscape of 2024.

Importance of Integrated Channels

Gone are the days when a visit to the bank was the only interaction customers had with their financial service providers. Now, an omnichannel approach is essential. This means providing a consistent customer experience across social media, mobile apps, emails, and in-person services. Aspect Software found that businesses that adopt omnichannel strategies have 91% higher year-over-year customer retention rates. Such integration boosts customer satisfaction and enhances trust and loyalty by providing consistent and personalized experiences across all channels.

Examples of Effective Omnichannel Strategies

Consider JPMorgan Chase & Co., which successfully integrates its mobile app, website, and physical branches. Customers can start a transaction on the app and finish it in a branch, or vice versa, ensuring convenience and continuity. Moreover, their use of data analytics to personalize customer interactions on each platform further strengthens their omnichannel effectiveness. Another example is the use of chatbots and AI-driven tools, like those offered by Plerdy, which help understand customer behavior and customize their experience on digital platforms.

Adopting an omnichannel approach for financial services aiming to thrive in 2024 and beyond isn’t just beneficial; it’s indispensable. Customers should be met where they are and given a consistent and personalized experience. As we move forward, the integration of various channels will drive customer satisfaction and be a significant differentiator in the competitive world of financial services.

Leveraging Data-Driven Marketing

In the ever-evolving world of financial services, data is the new gold. Leveraging data-driven marketing in 2024 isn’t just a smart move; it’s a cornerstone strategy for understanding and engaging with customers on a whole new level.

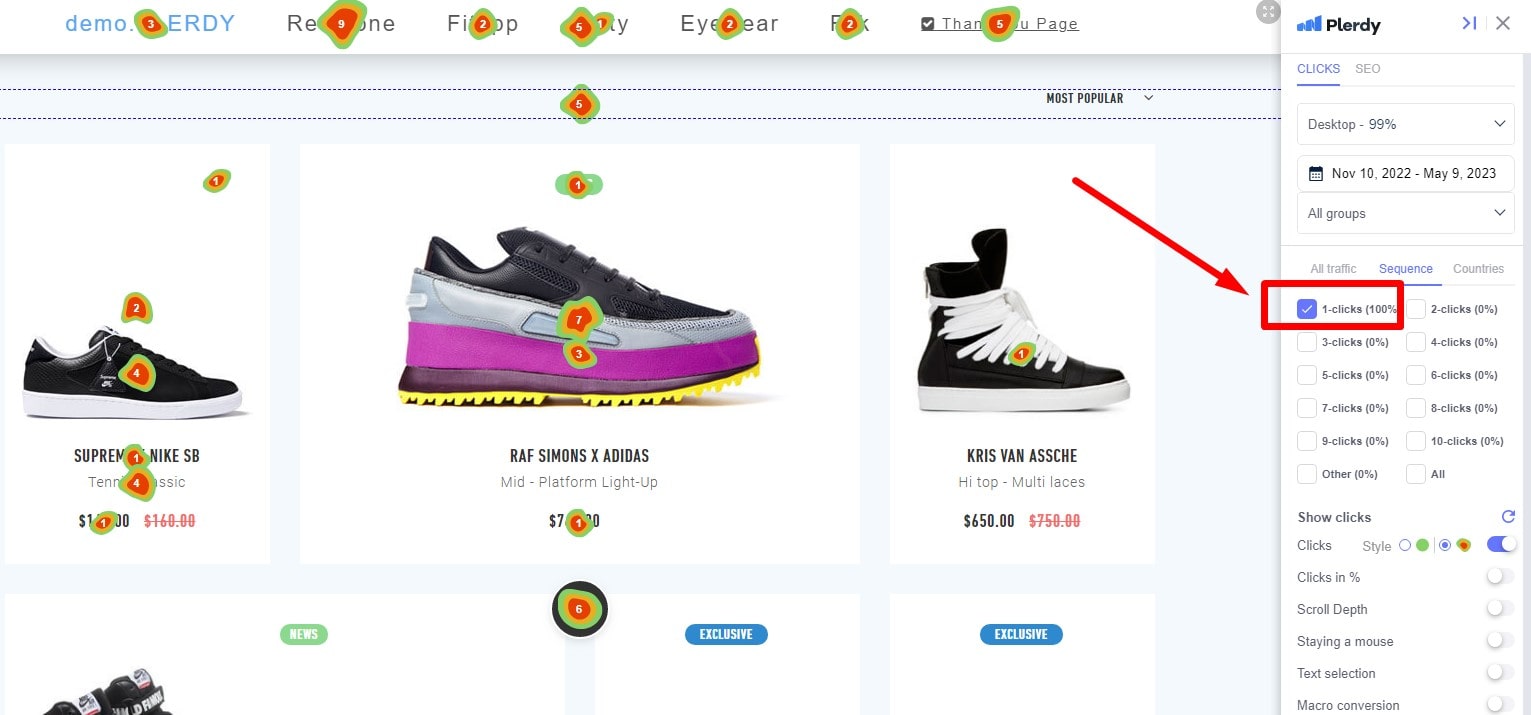

Tools and Techniques for Data Analysis

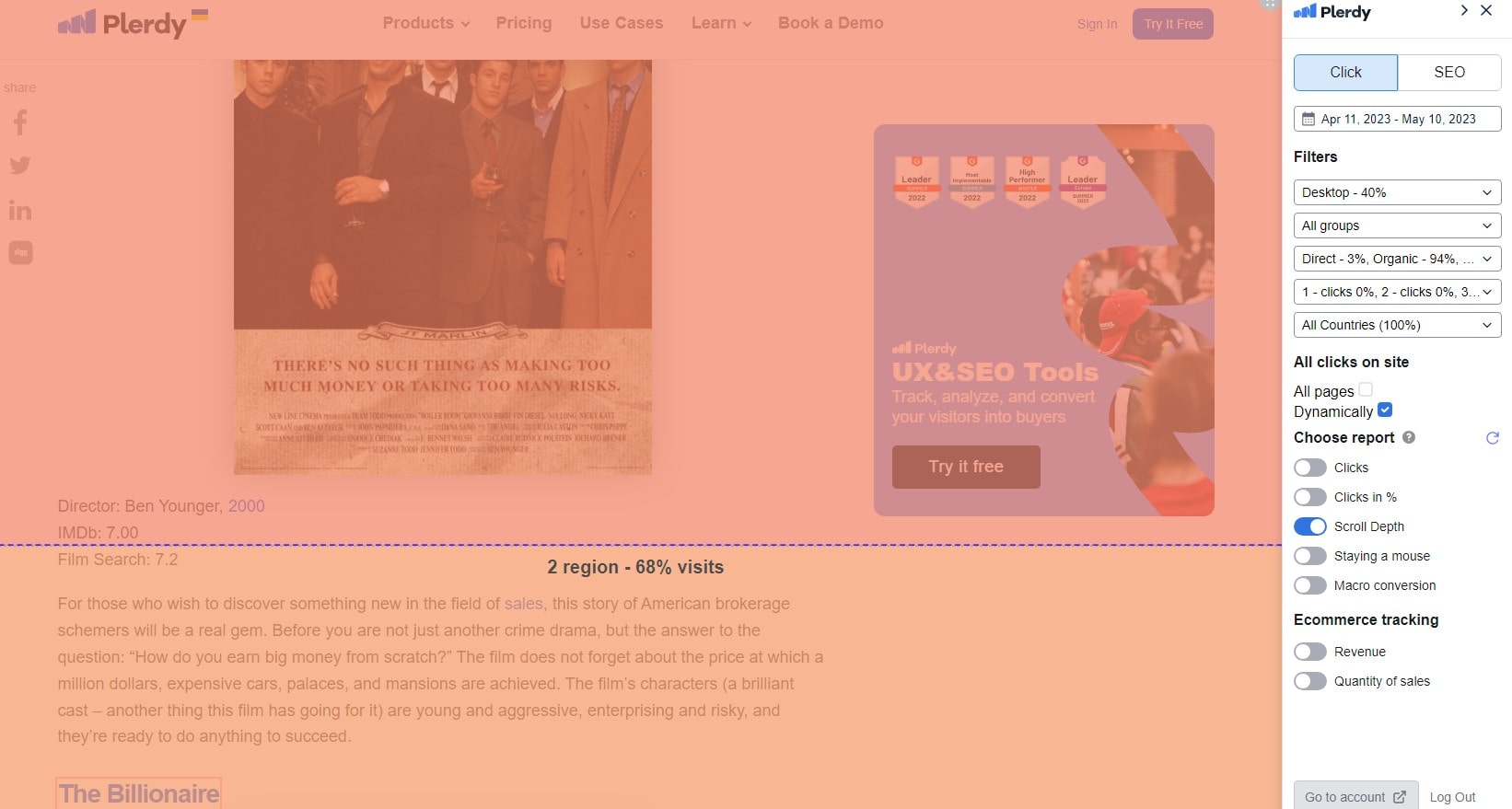

The crux of data-driven marketing lies in the tools and techniques to dissect large datasets. Financial institutions are using Plerdy heatmaps and behavior analytics to understand customer preferences. This information is crucial for creating targeted marketing campaigns that resonate with individual customers. For example, using CRM systems to track customer interactions across various touchpoints enables marketers to effectively tailor their messages and offers. Furthermore, machine learning algorithms help predict customer needs and preferences, enabling financial services to offer timely and relevant solutions.

Success Stories of Data-Driven Campaigns

A shining example of data-driven success is American Express. By analyzing transaction data, they’ve been able to create personalized card offers and rewards, significantly enhancing customer loyalty. Similarly, Capital One uses data analytics to optimize its credit risk assessment process, ensuring better customer segmentation and more tailored financial products.

Data-driven marketing is transforming the financial services industry. Institutions may maximize data potential for better decision-making and customer experiences using the proper tools and methods. The capacity to assess and act on data insights will differentiate successful financial services and propel the industry toward more innovative and customer-centric solutions.

The Power of Personalization in Financial Marketing

In the digital era 2024, where financial services are a click away, personalization isn’t just a feature – it’s the heartbeat of customer engagement. Personalized marketing in financial services has gone from ‘nice-to-have’ to must-have,’ changing how clients use financial goods and services.

Personalization Techniques and Tools

The art of personalization in financial marketing hinges on using sophisticated tools and techniques. Financial institutions can now analyze customer data, including spending habits and transaction history, using AI and machine learning to offer tailor-made financial solutions. For instance, tools like Plerdy provide insights into website user behavior, enabling customized user experiences. Technologies like predictive analytics allow financial institutions to anticipate customer needs and offer relevant products at the right time. For example, a bank might use spending pattern data to offer personalized credit card rewards, enhancing the user’s banking experience.

Impact of Personalization on Customer Engagement

Personalization significantly boosts customer engagement. Epsilon found that 80% of consumers buy more from brands that offer customized experiences. In the financial sector, clients receive offers and information relevant to their financial goals and lifestyles, leading to higher satisfaction and loyalty. Personalization also helps build trust, a critical component in financial services, as customers feel valued and understood.

Personalization in financial marketing is not just about selling products; it’s about creating a meaningful relationship with customers. As we advance, the financial institutions that succeed will recognize and implement personalization as a key strategy in engaging and retaining customers, ultimately driving growth and customer satisfaction.

Innovations in Digital Marketing – AI, Automation, and Beyond

AI and automation will transform financial services and digital marketing in 2024. These technological advancements are not just fancy add-ons but essential tools driving efficiency, personalization, and smarter marketing decisions.

Role of AI in Financial Services Marketing

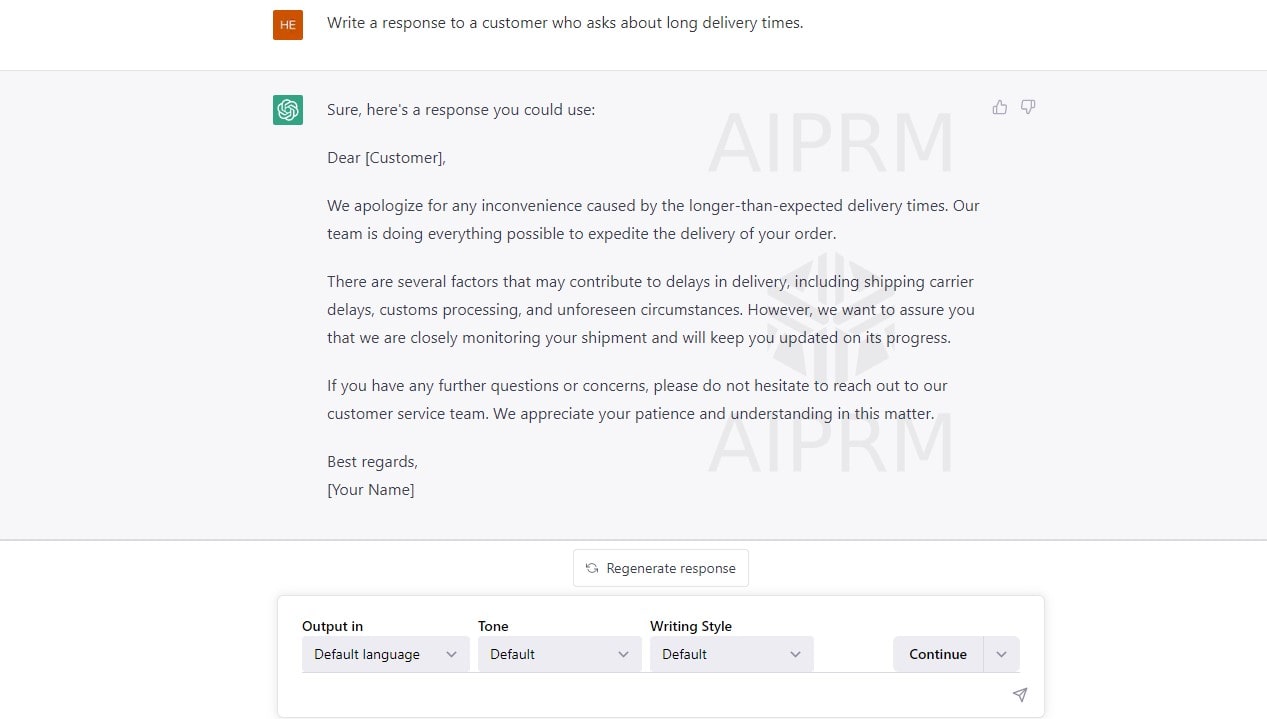

Artificial Intelligence (AI) in financial marketing has transitioned from a buzzword to a core component of strategic planning. AI systems can already find patterns and client preferences in massive data sets. This enables financial institutions to create more targeted and effective marketing campaigns. For instance, AI-driven predictive analytics can forecast customer behavior, helping banks and financial services to tailor their products and services proactively. AI also enhances customer interactions through chatbots and virtual assistants, providing real-time, personalized assistance, as seen in platforms like Plerdy, enhancing the overall customer experience.

The Future of Marketing Automation

Automation in digital marketing has streamlined numerous marketing tasks, from email marketing to customer segmentation. Automated workflows ensure consistent and timely customer engagement, increasing efficiency and reducing the potential for human error. Looking forward, we can expect automation to become more intelligent, with advanced algorithms making real-time decisions based on customer behavior and preferences. This shift will enable financial services to offer more personalized experiences at scale, a crucial factor in customer retention and acquisition.

AI and automation are not just shaping the present of financial digital marketing; they are carving its future. As we embrace these innovations, financial services can expect to see improved operational efficiency and deeper and more meaningful connections with their customers. The institutions that adapt and integrate these technologies will lead the digital marketing frontier, setting new benchmarks in customer engagement and service delivery.

Adapting to Changing Consumer Behaviors

In 2024, the financial services sector is navigating through a sea of changes in consumer behaviors. Rapid technological change and changing customer expectations are not merely trends but symptoms of a financial revolution.

Understanding the Modern Financial Consumer

Today’s financial consumer is tech-savvy, well-informed, and expects a seamless digital experience. They are inclined towards services that offer convenience, speed, and personalization. Mobile financial management is needed as mobile banking and digital wallets grow. Additionally, consumers are increasingly conscious of data privacy and the ethical practices of financial institutions. This changing behavior necessitates a shift in how financial services approach their customers. A study by Deloitte highlights the growing importance of understanding and adapting to these behavioral shifts to stay relevant and competitive.

Case Studies of Adaptive Marketing Strategies

Financial institutions like Bank of America have successfully adapted by integrating AI and machine learning into their services, offering personalized financial advice and predictive analytics. Another example is PayPal, which has capitalized on the trend of mobile transactions by enhancing its mobile app experience, making it more user-friendly and secure.

To adapt to shifting consumer behaviors, you must rethink client engagement and service delivery, not merely implement new technologies. Financial institutions that listen to and understand their customers’ evolving needs will survive and thrive in this dynamic environment. Building long-term customer connections and sustaining development in the ever-changing financial services industry requires agility and responsiveness.

Regulatory Compliance and the Integration of Emerging Technologies

Regulatory compliance is a significant aspect of financial marketing. As digital marketing practices evolve, so do the regulations governing them. Financial services must keep abreast of these regulations and integrate them seamlessly into their marketing strategies to ensure ethical practices and maintain customer trust. This includes following data protection laws like GDPR and ensuring transparent marketing communications. Noncompliance might result in legal issues and brand damage.

Blockchain technology increases transaction security and transparency, which can be used in financial services marketing to build trust and reliability. IoT, on the other hand, provides a wealth of data through connected devices, offering deeper insights into consumer behaviors and preferences. Financial services can harness this data to create more personalized and timely marketing strategies.

Financial services digital marketing’s future depends on properly and ethically integrating new technology to secure regulatory compliance and customer trust. As we move forward, financial services must balance innovation with responsibility, ensuring they remain on the cutting edge while upholding the highest standards of integrity and customer care.

Conclusion

As we conclude, it’s clear that the digital marketing landscape in financial services for 2024 is dynamic and ever-evolving. The key takeaway? Adaptability and innovation are not just beneficial; they’re essential. From embracing omnichannel marketing to leveraging AI and data-driven strategies, the future of financial marketing is about creating personalized, engaging customer experiences. Curious about more insights and strategies? Dive into other articles on Plerdy’s blog, where the fusion of marketing intelligence and technology comes to life. And remember, tools like Plerdy are here to help you navigate this complex but exciting digital marketing journey. Start optimizing your strategies with Plerdy today and stay ahead in the financial marketing game.