Imagine if your fintech marketing was so magnetic that even your grandma clicked “learn more.” In the rapidly evolving fintech landscape, standing out is not just an art; it’s a science. With the industry booming and competition fierce, a cunning marketing strategy is your golden ticket. That’s where understanding your audience comes in – it’s not just about reaching people; it’s about resonating with them. And who better to guide you through this journey than Plerdy? Their analytics tools are like the compass you never knew you needed, helping you navigate the bustling market precisely. Stick around, and let’s dive into transforming your fintech marketing from good to extraordinary.

Understanding Your Audience

Fintech marketing goes beyond demographics to understand your audience’s mind, behavior, and changing demands. This deep dive empowers fintech companies to align their offerings with the expectations and lifestyle of their audience, thus creating marketing strategies that are not just seen but felt and responded to.

Targeting Millennials and Gen Z

These cohorts represent a significant portion of the digital-native population actively seeking financial empowerment through technology. Their financial stress, as reported by the National Endowment for Financial Education, underscores a gap in the market for educational content that demystifies personal finance, offering practical, actionable advice. By crafting content that addresses their financial anxieties with empathy and authority, fintech companies can forge a bond of trust and reliability with these generations. Incorporating financial transformation and success stories can inspire and engage, making the financial journey relatable and achievable.

Analytics Tools and Techniques

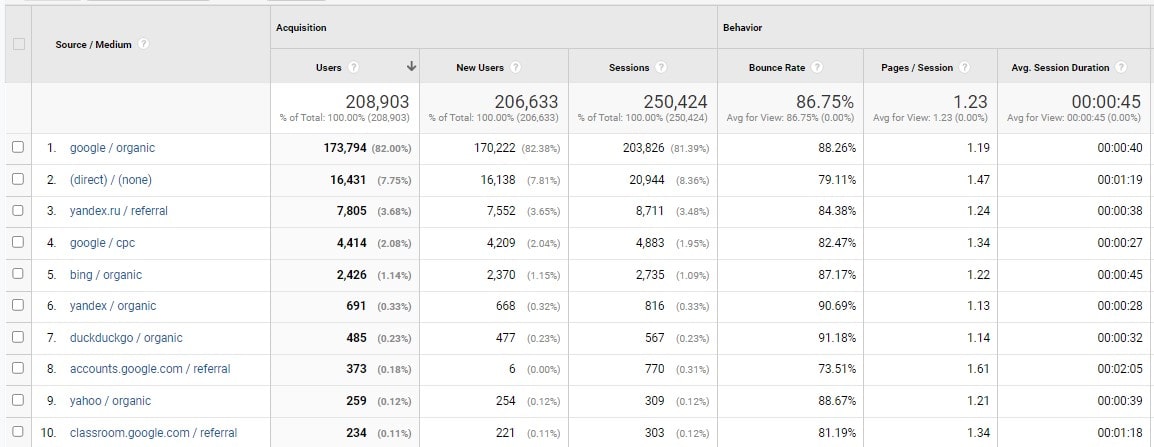

Delving into analytics offers a panoramic view of your audience’s online behavior, preferences, and pain points. Tools like Google Analytics or Plerdy track engagement metrics and unveil patterns that can inform content strategy, product development, and user experience enhancements. For example, a high bounce rate on a specific product page could indicate confusion or a mismatch between the product offering and the audience’s expectations. Similarly, engagement metrics can highlight content types or topics that resonate most, guiding a more targeted content strategy.

Segmentation, facilitated by analytics tools, enables fintech companies to personalize their marketing efforts. Tailoring messages and solutions to specific segments based on their behavior and interests ensures that marketing efforts are relevant and compelling. When done right, personalization can significantly increase conversion rates and customer loyalty.

Engaging with Your Audience

The digital landscape offers myriad engagement channels, from social media platforms to forums and webinars. Channels should match your audience’s inclinations. Interactive platforms like Twitter and LinkedIn offer opportunities for real-time engagement, allowing fintech companies to participate in conversations, answer questions, and showcase their thought leadership.

However, engagement extends beyond digital channels. Community events, webinars, and user groups offer physical spaces to connect, understand, and gather feedback from your audience. These interactions can shed light, build brand loyalty, and promote community.

Fintech marketing requires empathy, data, and engagement to understand your audience. It’s about identifying not just who your audience is but what they need, how they feel, and where they seek information. Leveraging analytics tools provides the data backbone for personalized, impactful marketing strategies. Meanwhile, genuine engagement, both online and offline, bridges the gap between fintech companies and their audiences, turning transactions into relationships. As fintech continues to evolve, so must our approaches to understanding and connecting with our audiences.

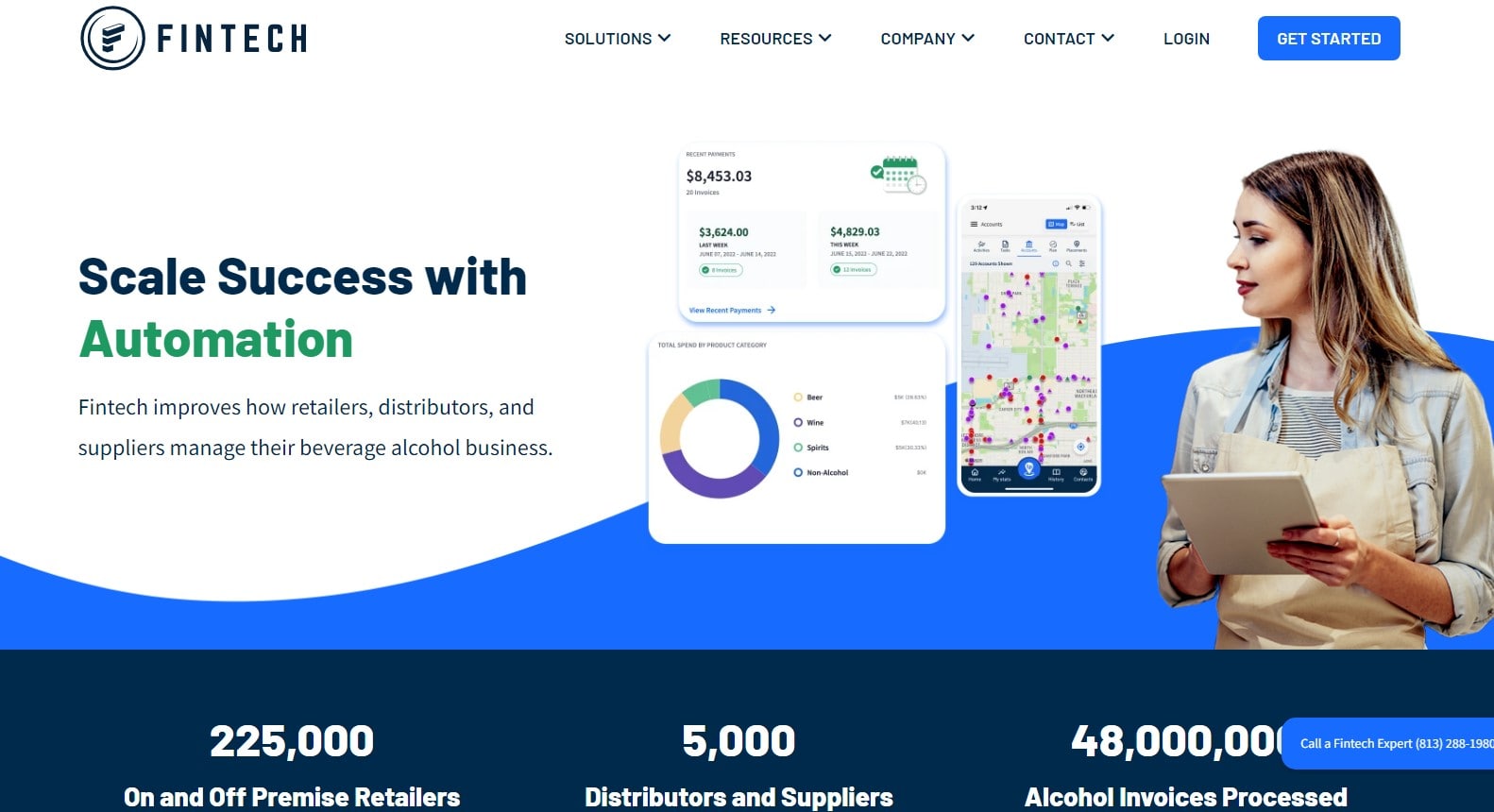

Leveraging Digital Marketing Channels

In today’s digital age, not leveraging digital marketing channels is like trying to sail a boat without a compass. For fintech companies, the digital landscape offers many opportunities to connect with potential customers. But to navigate these waters effectively, you need to understand which channels will most efficiently guide you to your destination.

SEO Strategies

SEO is the wind in your sails in the digital world. It boosts search engine rankings, making your website more visible to customers. Important steps include incorporating relevant keywords, optimizing website speed, and ensuring mobile responsiveness. According to Moz, websites on the first page of search results grab up to 92% of traffic from the average search.

Content Marketing

Content is the beacon that attracts customers to your shores. Informative blogs, insightful articles, and engaging videos can establish your fintech as a thought leader in the industry. Content marketing is about developing trust, connections, and value, not just selling products.

Social Media Engagement

Social media platforms are bustling marketplaces where conversations never cease. Platforms like LinkedIn for B2B or Instagram and Twitter for B2C can significantly amplify your brand’s voice. Content marketing builds trust, connections, and value, not just products.

Email Marketing Best Practices

Email marketing is the treasure map that leads customers through your sales funnel. Personalized emails, segmented lists, and clear calls-to-action can increase open rates and conversions. HubSpot reports that email is one of the greatest ROI marketing mediums at $42 every $1.

The key to leveraging these digital marketing channels is consistency and personalization. Understanding your audience’s preferences and behaviors allows you to tailor your strategies for maximum engagement and conversion.

In the vast ocean of digital marketing, success comes from knowing your bearings. Your fintech company may increase visibility and client interaction by strategically using SEO, content marketing, social media, and email. These channels are tools and lifelines connecting you with your digital audience.

The Power of Mobile Marketing

In an era where smartphones are as ubiquitous as wallets, ignoring mobile marketing is like leaving money on the table. Mobile is a portal for fintech companies to engage directly with consumers where they spend a lot of their day. The power of mobile marketing lies in its immediacy and accessibility, offering unparalleled opportunities to connect with users on a personal level.

Optimizing for Mobile

Make your website and content mobile-friendly—it’s not optional. Google reports that 53% of mobile site visitors depart if the page takes more than three seconds to load. Mobile responsiveness and speed are crucial for customer engagement.

Innovative Mobile Marketing Tactics

Beyond responsive design, leveraging mobile-specific tactics can significantly enhance user engagement. This includes push notifications, which, according to Airship, can lead to a 3x increase in retention rates when used effectively. Mobile apps also open up avenues for personalized marketing through in-app messages and offers, tapping into the user’s specific interests and behaviors.

The key to unlocking the full potential of mobile marketing is to understand its unique advantages. It allows for more personalized, timely, and location-based marketing efforts that can lead to higher conversion rates and customer loyalty.

Mobile marketing is not just about being seen but about feeling. It’s creating that instant connection with your audience, offering them solutions at their fingertips. By prioritizing mobile optimization and embracing innovative tactics, fintech companies can harness the power of mobile marketing to reach their audience and resonate with them on a deeper level.

Content is King: Creating Valuable Fintech Content

In the fintech world, where technology evolves at breakneck speed, content isn’t just king; it’s the entire kingdom. A well-crafted piece of content can educate, inspire, and convert your audience, making it an indispensable tool in your marketing arsenal. However, developing content that resonates with your audience involves more than industry knowledge—it requires a deep grasp of their requirements and how your solutions may address them.

Identifying Topics of Interest

Know what your audience cares about. What financial challenges are they facing? How can your fintech solution help? Addressing these questions in your content demonstrates your expertise and builds trust with your audience. For instance, a survey by PwC found that 77% of banking customers prioritize speed, convenience, and helpful service. Tailor your content to show how your fintech solution delivers on these expectations.

Formats That Engage

Diversify your content formats to engage different segments of your audience. Blog posts and articles are great for in-depth explanations, while infographics and short videos can simplify complex financial concepts. Interactive webinars and podcasts can also foster a deeper connection with your audience by providing valuable insights in an engaging format.

- Measuring Content Success: It’s crucial to track the performance of your content. Google Analytics shows which content gets traffic and engagement. This data lets you focus on audience needs as you adjust your content strategy.

Creating valuable fintech content is more than just a one-and-done affair. Understanding your audience, trying alternative forms, and refining your strategy based on feedback and analytics is ongoing. By putting your audience’s needs at the center of your content strategy, you can transform your fintech solution from an option to a necessity. In a world inundated with information, the right piece of content can be the beacon that guides your audience to your solutions.

Utilizing Influencer and Affiliate Marketing

In the digital era, where everyone’s online voice can potentially echo globally, influencer and affiliate marketing have emerged as powerful strategies for fintech companies. These methods don’t just amplify your message; they lend it credibility and authenticity, which can be particularly valuable in an industry where trust is paramount.

Choosing the Right Influencers

The first step is identifying influencers whose followers align with your target audience. It’s not just about the numbers; it’s about engagement and relevance. An influencer with a smaller, more dedicated following in the fintech space can often offer more value than a celebrity with millions of followers but no real connection to financial technology. Tools like BuzzSumo can help identify potential influencers by showing who has authority in your niche.

Setting Up an Affiliate Program

Affiliate marketing works with people or firms (affiliates) who promote your product for a commission on sales or leads. It’s a win-win: you get targeted exposure, and affiliates earn from promoting products they believe in. Platforms like ShareASale or Impact can facilitate these partnerships, providing tools to track and manage your affiliates effectively.

It’s crucial to remember that influencer and affiliate marketing are different from set-and-forget strategies. They require ongoing management, relationship building, and optimization to truly drive success. But when done right, they can significantly extend your fintech brand’s reach and credibility, turning audiences into advocates and customers into community members. In a landscape as competitive as fintech, these strategies offer a way to stand out and connect with your audience on a level that traditional marketing can’t match.

Prioritizing Security and Building Trust

In the fintech sector, where transactions and data flow like rivers, the banks of security and trust must be strong and unbreachable. Customers are not just looking for convenience; they demand assurance that their financial data is safe. Prioritizing security and trust is not just a value-added service; it’s the foundation upon which successful fintech companies are built.

Highlighting Security Features

Your fintech’s commitment to security should be front and center, not buried in the fine print. Transparency in security measures, such as encryption and fraud detection algorithms, can reassure customers. The Federal Trade Commission emphasizes the importance of transparent data practices to build customer trust.

Compliance and Certifications

Adhering to industry standards and obtaining security certifications is non-negotiable. Compliance with regulations like GDPR or PCI DSS demonstrates your commitment to security and builds credibility. Highlighting these certifications on your platform and marketing materials can be a badge of trust for customers.

Engaging with Customers on Security Issues

Open communication about security issues and how they are addressed can strengthen trust. Providing resources and education on how customers can protect their data further demonstrates your commitment to their security. Engaging in this dialogue shows that you view your customers as partners in the security process, not just end-users.

It’s clear that in the fintech world, security and trust are not just about protecting data; they’re about protecting relationships. By prioritizing these elements, fintech companies can create a secure environment where customers feel valued and protected. This commitment to security and trust separates the leaders from the followers in the fintech industry. Building a foundation of trust through robust security practices and open communication safeguards your business and solidifies your reputation as a reliable fintech provider.

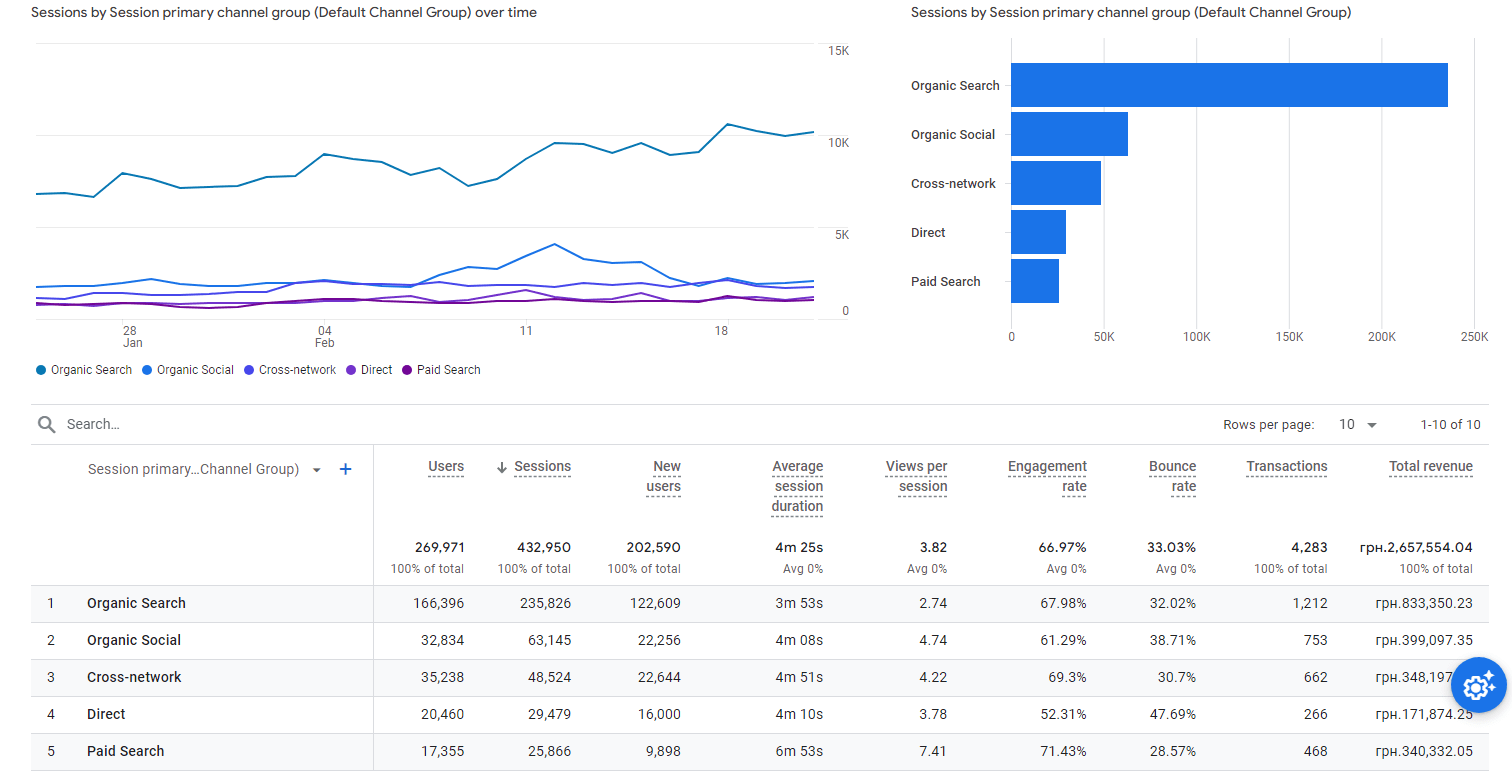

Measuring and Analyzing Marketing Performance

Sailing the digital seas without a compass in fintech marketing can lead you astray. Measuring and analyzing marketing performance is your compass, guiding your strategies towards true north—ROI and customer satisfaction. With the right analytics, you’re not just guessing; you’re making informed decisions that drive your fintech forward.

Key Performance Indicators (KPIs)

Finding the right KPIs is key. They could include website traffic, conversion rates, client acquisition expenses, and lifetime value. Forbes suggests tracking these data to assess marketing performance and better spend resources.

Tools for Analytics and A/B Testing

Tools like Google Analytics provide a treasure trove of data on user behavior. At the same time, platforms like Optimizely can facilitate A/B testing, allowing you to refine your marketing messages and channels for optimal performance. These tools are indispensable for understanding what resonates with your audience and why.

Measuring and analyzing marketing performance in the fintech sector isn’t just about numbers; it’s about understanding the story behind those numbers. It’s about discerning what works, doubling down on it, and perhaps more importantly, recognizing what doesn’t and pivoting accordingly. A cycle of testing, measuring, learning, and optimizing guarantees your marketing efforts are visible and effective. This analytical approach helps fintech marketing tactics succeed in a competitive environment.

Conclusion

More than a fantastic product, fintech marketing requires a plan that resonates with your target, employs digital channels efficiently, emphasizes security, and regularly analyzes performance for improvement. As we’ve explored these pivotal areas, remember that the journey doesn’t end here. The fintech sector is ever-evolving, and staying ahead means continuously seeking knowledge and adapting strategies. Hungry for more insights? Dive deeper into the world of fintech marketing with other articles on Plerdy’s blog, where we unravel the complexities of digital marketing. Let Plerdy be your guide to navigating and mastering the digital marketing seas.