Imagine insurance marketing as a grand dinner party. You’ve got the glitzy venue (the digital realm) and the gourmet menu (your services), but if your invites (marketing strategies) could be better, you’ll be dining alone. In a world where digital presence is as crucial as the policies you sell, leveraging innovative digital marketing strategies isn’t just smart; it’s essential. That’s where Plerdy steps in—a beacon for those navigating the vast digital marketing seas, ensuring your efforts are seen and truly resonate with your audience. In this introduction, we’ll journey through the seven best strategies that transform browsers into buyers, all while keeping it concise, engaging, and directly to the point.

Understanding Your Audience

Diving into the digital marketing ocean without knowing who’s swimming there is like setting sail without a compass. Your audience is your North Star, guiding every decision and direction. Understanding who they are is not just beneficial; it’s the cornerstone of any successful marketing strategy.

Creating Customer Personas

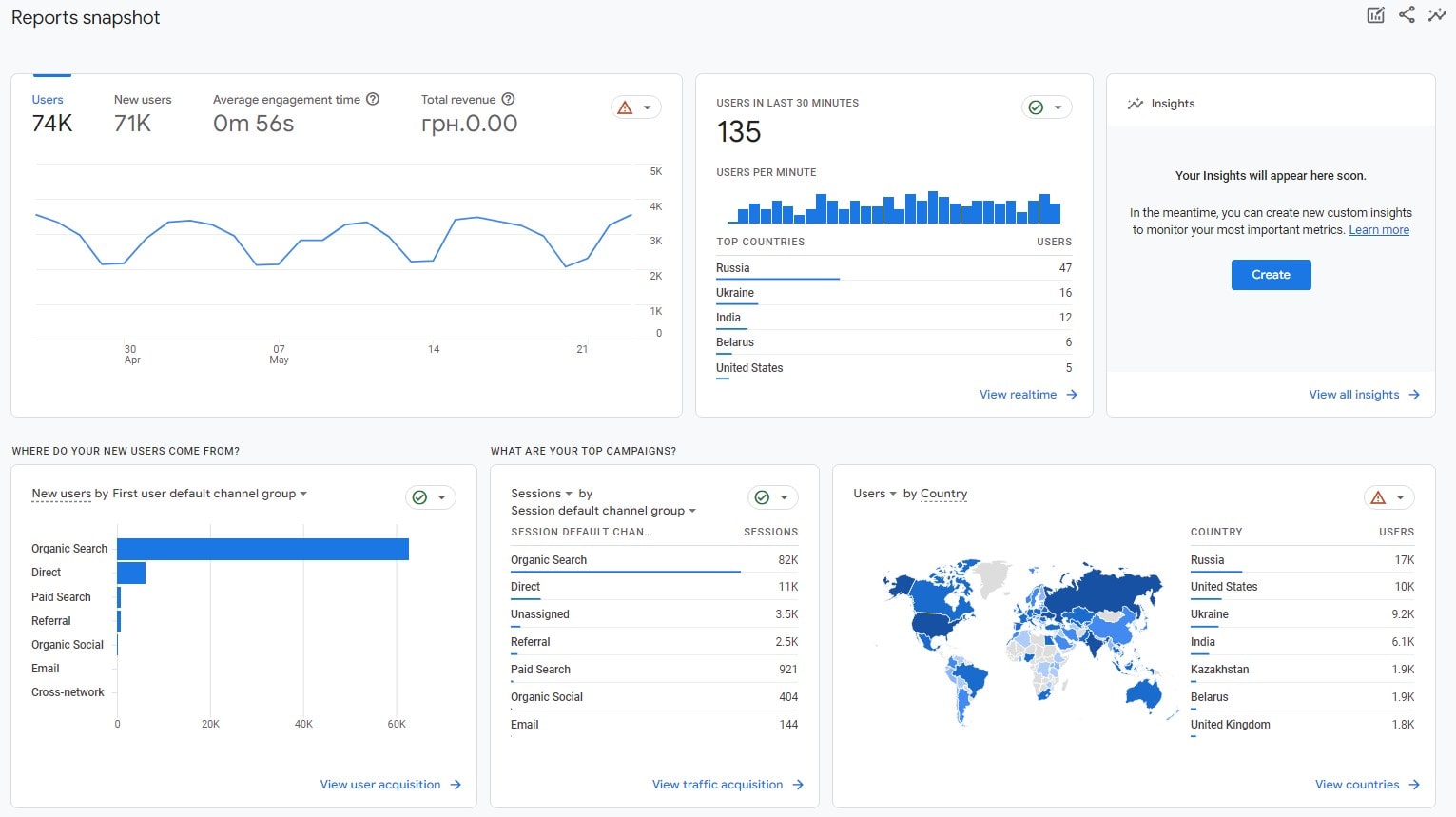

The first step in understanding your audience is to create detailed customer personas. These semi-fictional people are your ideal consumers based on genuine facts and educated guesses about demographics, behavior, motivations, and aspirations. Tools like Google Analytics provide insights into your audience’s age, location, and interests, offering a solid foundation for your personas. Understanding their difficulties and needs lets you make targeted marketing communications.

Utilizing Personas for Targeted Marketing

Once your personas are set, it’s time to put them to work. Each persona should inform how you customize your marketing across channels. For example, suppose one of your personas is a tech-savvy millennial. In that case, you might focus on social media platforms like Instagram or Twitter and use a more casual tone. Conversely, LinkedIn and email newsletters with a more formal tone might be more effective for a persona representing an older, professional demographic.

Incorporating personas into your marketing strategy allows you to create resonant content, choose channels that reach your audience, and ultimately, deliver messages that convert. According to HubSpot, Personas make tailored websites 2-5 times more effective and easier to use.

Understanding your audience through creating and applying customer personas is more than sending messages into the digital void. It’s about ensuring those messages land in the right inboxes, speak the right language, and hit the right notes. Your audience is out there. Use personas to find them, understand them, and engage them. This is not just marketing; it’s connecting.

Leveraging SEO and Content Marketing

In the digital age, your content doesn’t just compete with rivals in the insurance sector; it vies for attention in a crowded online world. SEO and content marketing are your allies in this battle, enhancing visibility and establishing authority.

Effective SEO Strategies

At the heart of SEO is understanding what your potential customers are searching for online. Keyword research is crucial; tools like Google’s Keyword Planner can help you find terms your audience uses. These keywords boost search engine rankings when included in website content, meta descriptions, and titles. SEO isn’t just about being seen; it’s about being seen by the right people. According to Moz, targeting specific, relevant keywords can increase the quality of traffic to your website, making visitors more likely to convert.

Content Marketing Excellence

Digital marketing is ruled by content. Some content reigns more than others. High-quality, informative content that addresses your audience’s questions and concerns establishes your brand as an authority. This could be blog posts explaining the intricacies of insurance policies or infographics that break down complex insurance data into digestible pieces. Content that provides value boosts engagement and shares, enhancing SEO efforts. The Content Marketing Institute found that content marketing yields three times the number of leads at a 62% lower cost compared to outbound marketing.

In integrating SEO and content marketing, consistency is key. Updated webpages show search engines that your site is useful, enhancing ranks. Furthermore, engaging content encourages visitors to spend more time on your site, reducing bounce rates and boosting your SEO performance.

Leveraging SEO and content marketing isn’t just a tactic; it’s an essential strategy for any insurance company looking to thrive online. Understanding and implementing effective SEO practices and producing valuable content can significantly improve your online presence, attract a more engaged audience, and drive conversions. This dual approach helps you stand out in a crowded digital landscape and builds a lasting relationship with your customers.

Enhancing Insurance Digital Marketing through Mobile Optimization

In the dynamic landscape of insurance digital marketing, mobile optimization of your website is crucial. Mobile and user experience are crucial to digital marketing strategies since many web traffic comes from mobile devices. This approach welcomes your visitors and encourages their engagement and potential conversion into loyal clients.

Mobile-Friendly Insurance Marketing Strategies

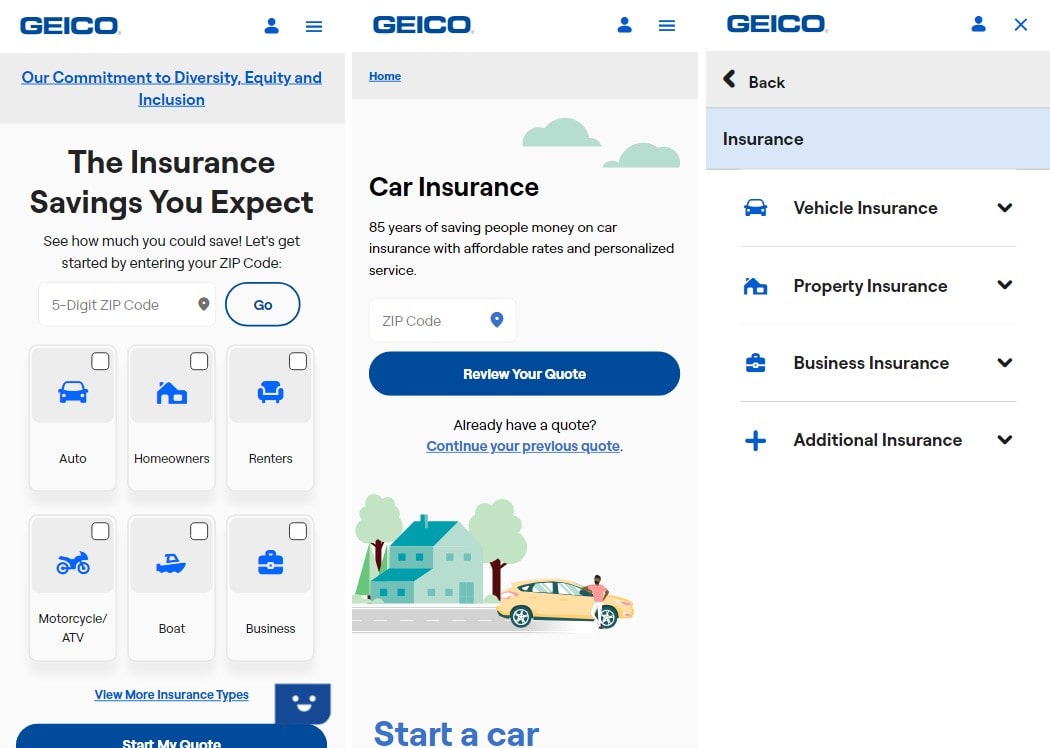

For insurance digital marketing, having a mobile-friendly website means ensuring seamless access across all devices – desktops, tablets, and smartphones. This includes implementing responsive design, which Google highly favors as a key ranking factor. Additionally, speed is a critical aspect. Employing Accelerated Mobile Pages (AMP) can drastically improve loading times, enhancing user experience and satisfaction. Tools like Google’s PageSpeed Insights provide valuable insights to optimize your insurance website’s performance on mobile platforms.

User Experience (UX) in Insurance Website Design

A mobile-optimized insurance website must also be user-friendly. Insurance digital marketing thrives on streamlined navigation, quick-loading pages, and clear calls to action, all pivotal in UX design. Each interaction – be it a click, swipe, or tap – should be intuitive and effortless. For example, incorporating a clickable contact number enhances UX for mobile users looking to get in touch with insurance services easily. Research by Adobe indicates that people prefer engaging with aesthetically pleasing and well-designed content over plain content, especially when reading online.

In insurance digital marketing, optimizing for mobile and user experience is about leading the way, not just following trends. A swiftly loading, visually appealing, and easily navigable website will likely keep visitors and convert them into clients. In today’s digital environment, potential clients generally visit your insurance website first. A strong, good impression is crucial.

Leveraging Social Media in Insurance Digital Marketing

In the digital age, social media is like a vibrant, ever-evolving marketplace, and for the insurance industry, it’s an indispensable platform for digital marketing. Leveraging social media in insurance marketing is not merely about broadcasting your message; it’s about creating meaningful connections, building trust, and engaging interactively with your audience.

Developing a Strategic Social Media Presence

Effective social media presence in insurance digital marketing starts with selecting the appropriate platforms. Different social media channels cater to different audiences, and insurance businesses must identify where their potential clients are most active. Quality trumps quantity. LinkedIn works well for B2B insurance marketing, but Facebook may work better for B2C. Per Sprout Social, brands followed on social media are more likely to attract customer purchases, highlighting the significance of being present on the right platforms.

Fostering Engagement and Community in Insurance Marketing

In the realm of social media, engagement is key. Insurance digital marketing strategies should focus not just on posting content but also on engaging with the audience. Responding to comments, participating in discussions, and addressing concerns can lend a human touch to the insurance brand. Creating and sharing valuable content like educational articles, informative videos, or engaging polls can stimulate interactions and cultivate a community around the insurance brand. This approach to digital marketing fosters engagement and nurtures loyalty and a sense of community, which are vital for customer retention in the insurance sector.

Social media marketing is essential to insurance digital marketing. It allows direct communication, client insights, and personalization of the insurance brand. By strategically choosing platforms, crafting impactful content, and engaging genuinely with the audience, insurance companies can leverage social media to enhance their reach, build customer loyalty, and thrive in the competitive digital marketplace. Success in social media for insurance companies lies in being as much about listening and engaging as it is about sharing your message.

Utilizing Email Marketing and Automation

Email marketing is the trusty hammer in the digital marketing toolbox—essential, reliable, and powerful when used correctly. In the insurance industry, where building and maintaining trust is paramount, email marketing and automation are not just about sending messages; they’re about nurturing relationships and providing value at every touchpoint.

Designing Effective Email Campaigns

Crafting emails that resonate starts with segmentation. Customize your messages to your audience segments’ requirements, interests, and customer journey stages. A personalized approach, as supported by Campaign Monitor, can increase email open rates by up to 26%. It’s about sending the right message to the right person at the right time, from welcoming new subscribers to educating them about the value of insurance to guiding them through policy renewal reminders.

Leveraging Automation Tools

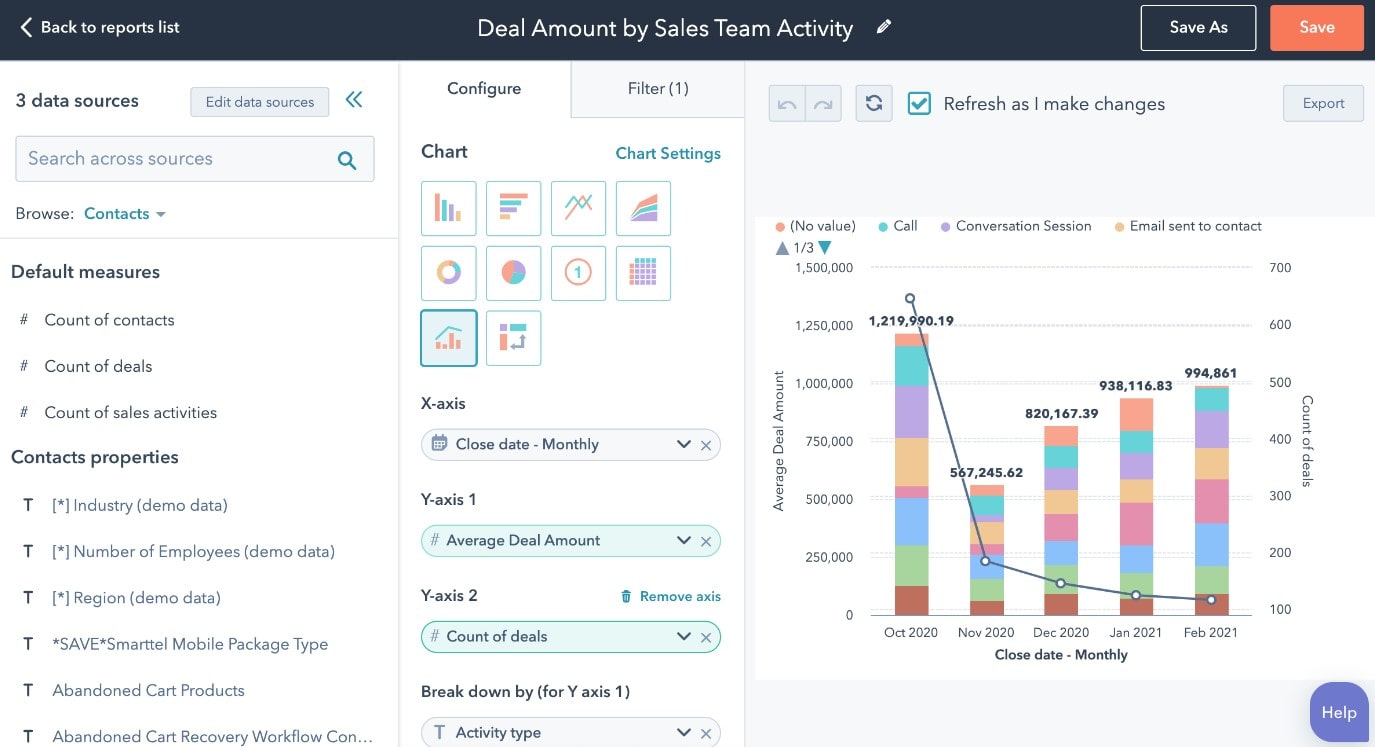

Automation transforms your email marketing strategy from a manual, time-consuming process to a streamlined, efficient operation. Tools like Mailchimp or Plerdy offer the ability to schedule campaigns, trigger emails based on specific actions, and analyze the performance of your emails in real time. This means you can set up a series of emails to educate new subscribers about your services, remind policyholders about renewals, or even celebrate personal milestones, enhancing customer engagement and retention.

Utilizing email marketing and automation in the insurance sector is about much more than just sending out newsletters. It lets you educate, engage, and bond with your audience. Personalized, targeted content and automation can boost communication relevance and loyalty. Email marketing should give value and create trust one email at a time.

Innovative Use of Technology and Data Analytics

Technology and data analytics guide marketing tactics into unexplored realms in the information era. These tools can unleash insights that can transform insurance firms’ client relationships, not just keep up with trends.

Harnessing Data for Customer Insights

The first step in utilizing technology and data analytics is gathering and analyzing customer data. This process involves collecting information from various touchpoints and using analytical tools to decipher patterns and behaviors. Insurance companies can predict customer needs, tailor their marketing strategies, and deliver personalized experiences by understanding these patterns. Forbes says organizations that employ customer behavior insights grow revenues 85% faster.

Technology in Marketing Automation and Personalization

With the insights gained from data analysis, the next step is applying technology to automate and personalize marketing efforts. This can range from personalized email campaigns based on customer segments to chatbots that provide instant, tailored assistance. Automation tools streamline marketing operations and ensure each customer interaction is relevant and timely. As highlighted by McKinsey, personalization can deliver five to eight times the ROI on marketing spend and lift sales by 10% or more.

Innovative technology and data analytics offer a competitive edge in the saturated insurance market. It enables companies to understand their customers deeper, predict their needs, and engage them with personalized, relevant content. As the digital landscape evolves, the insurance companies that leverage these tools will see improved customer satisfaction and loyalty and significant growth in their marketing ROI. Modern insurance companies need technology and data analytics for future success, not just marketing.

Analyzing and Adapting Strategies

In the dynamic world of digital marketing, something other than what worked yesterday might work better today. That’s why analyzing and adapting your strategies is not just wise—it’s essential for survival. For insurance companies, staying agile means staying ahead.

Key Performance Indicators (KPIs)

The first step in the analysis is identifying which metrics matter most to your business. These KPIs range from website traffic and conversion rates to customer retention and engagement levels on social media. By monitoring these indicators closely, you can gauge the effectiveness of your marketing strategies. For instance, a low conversion rate might indicate your website’s user experience needs improvement.

Continuous Improvement

Armed with data, the next step is adaptation. This means making informed decisions to tweak and refine your strategies for better outcomes. Perhaps the data shows that your email marketing campaigns have a high open-rate but low click-through. This insight could lead you to adjust your email content or call to action to engage your audience better. The goal is not to set and forget but to evolve continually. As HubSpot suggests, marketing is about testing, learning, and iterating.

In the ever-changing digital marketing landscape, the ability to analyze and adapt is crucial for insurance companies. Setting clear KPIs and being willing to make changes based on data ensures that your marketing efforts remain effective and relevant. This ongoing process of analysis and adaptation helps optimize current strategies and paves the way for discovering new opportunities for growth and engagement.

Conclusion

Embarking on a digital marketing journey in the insurance industry is akin to navigating a vast sea. With the strategies discussed, from understanding your audience to leveraging technology and data analytics, you’re now equipped with the compass and map for a successful voyage. The digital landscape is ever-evolving, requiring continually adapting and refining your strategies. Curious about more insights and strategies that could propel your marketing efforts even further? Dive into the wealth of articles available on Plerdy’s blog. Each piece is a treasure trove of knowledge waiting to be discovered. Ready to enhance your digital marketing arsenal? Explore Plerdy today and see how our tools can amplify your online presence.