Imagine a world where banks still relied solely on billboards and newspaper ads for marketing—quite a blast from the past, right? Today, the financial landscape has drastically evolved, and SEO has emerged as a pivotal player in the banking sector. In this digital era, where most customer journeys begin with a simple online search, banks can’t afford to overlook the power of effective SEO strategies. It’s not just about being visible; it’s about being found by the right people at the right time. That’s where SEO comes into play, ensuring that when potential clients are searching for banking services, your institution shines at the top. Here at Plerdy, we understand the nuances of digital marketing and the critical role of SEO in enhancing a bank’s online presence. Stay tuned as we explore bank SEO best practices to stay ahead in the digital competition.

Understanding the Importance of SEO in Banking

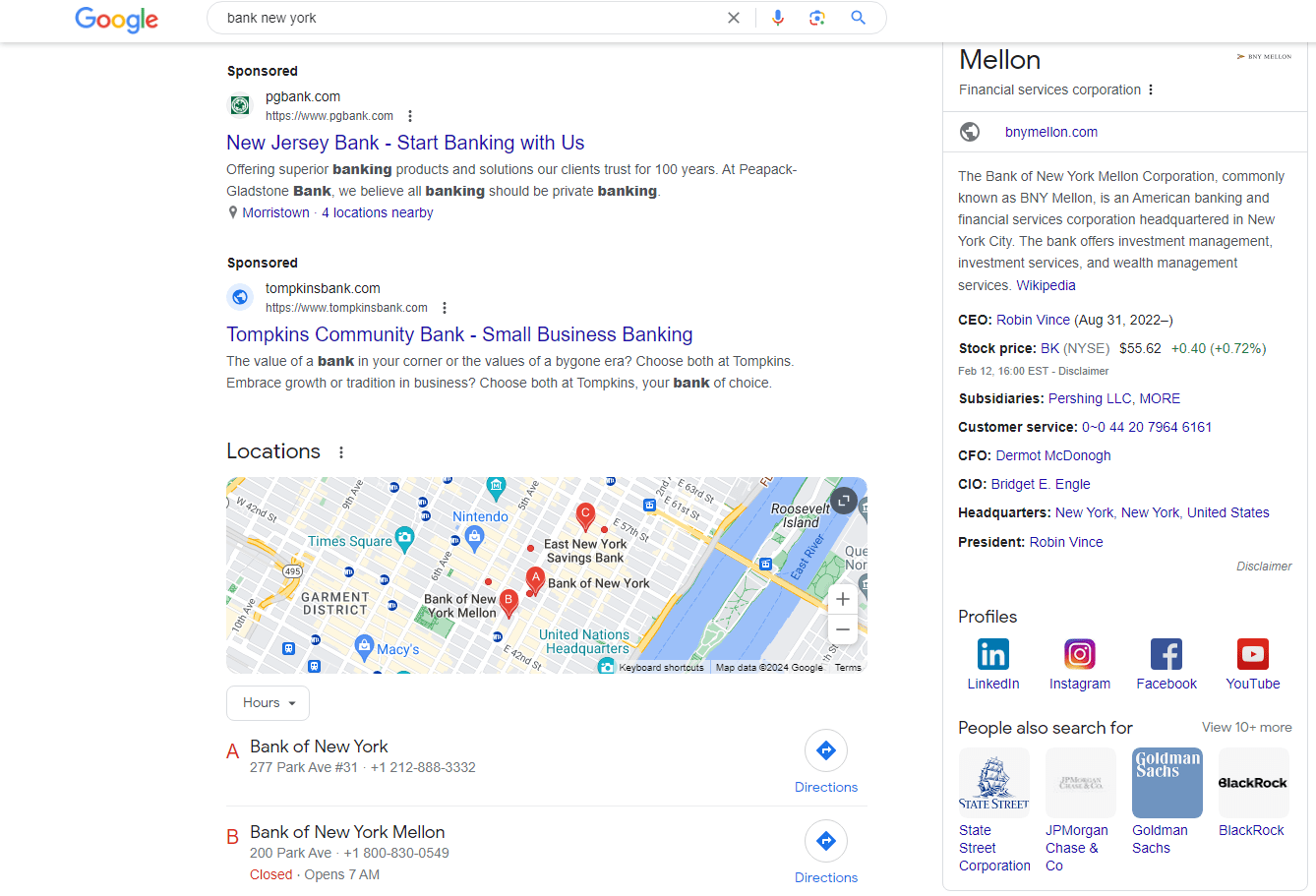

In the high-stakes game of banking, not being on the first page of Google is like having a hidden branch: nobody knows you’re there! SEO in banking isn’t just about getting to the top; it’s about connecting with customers who are actively seeking your services. In an industry where trust and reliability are paramount, showing up prominently in search results can significantly influence customer perception and decision-making.

The Competitive Landscape

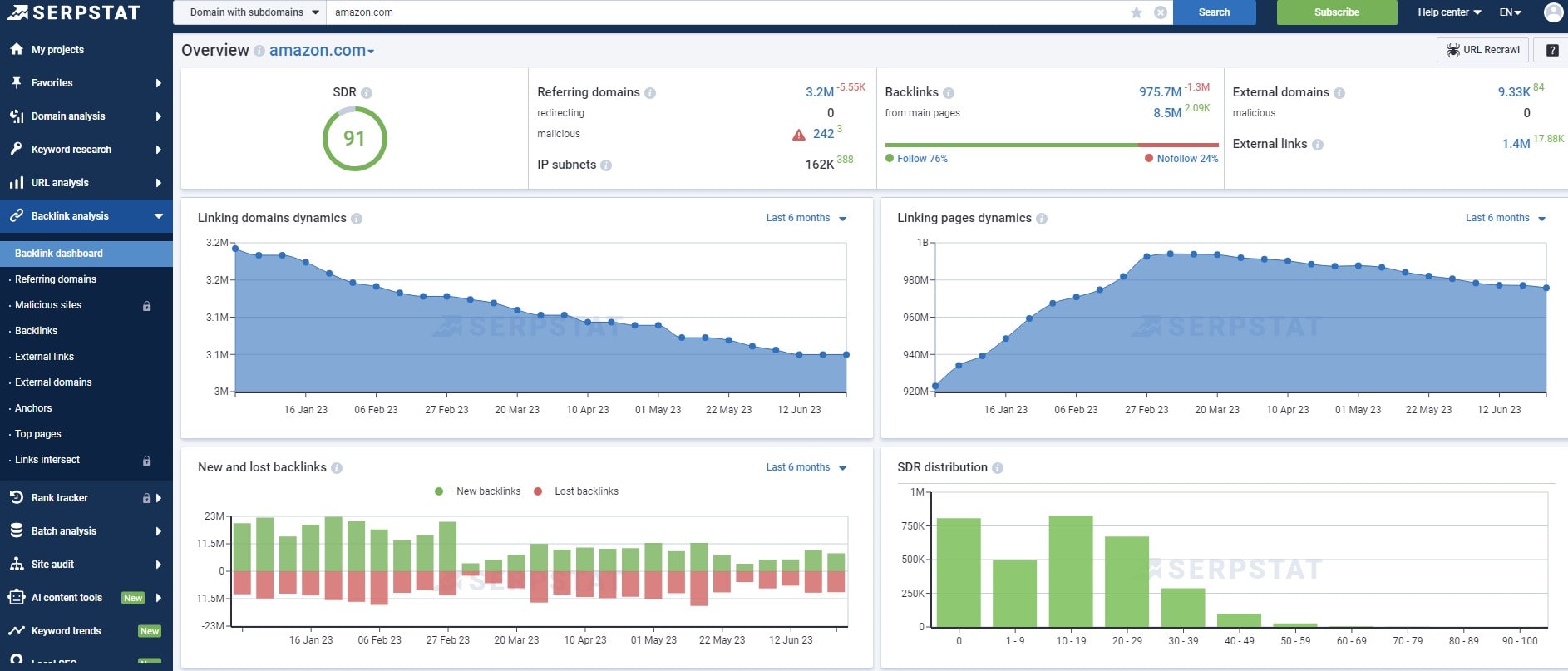

In the banking sector, competition is fierce. Banks aren’t just competing with each other but also with a myriad of fintech startups. A solid SEO strategy helps banks stand out in this cluttered marketplace. It’s not just about attracting eyes; it’s about attracting the right eyes. Banks can reach customers seeking for specialized banking services with targeted keywords and optimized content. According to Moz, a well-ranked website can increase a business’s visibility and credibility, essential in an industry where trust is a key deciding factor.

Enhancing Online Visibility

Imagine a scenario where a potential customer types in “best mortgage rates near me” and your bank pops up as the top result. That’s the power of SEO in enhancing online visibility. By leveraging SEO, banks can ensure that their services appear front and center when it matters most. It’s about being the first port of call for financial queries. As Search Engine Journal highlights, top-ranking pages get significantly more traffic than those buried down the list. In the banking world, where products can be complex, appearing at the top can also help demystify services, making them more accessible to the average consumer.

Understanding the importance of SEO in banking is crucial in today’s digital age. It’s not just a marketing tactic; it’s a bridge connecting banks to their potential customers in the most direct and efficient way possible. SEO connects users to banking services, making it a vital tool in a saturated industry.

Key SEO Strategies for Banks

Navigating the digital world without SEO is like trying to find a new bank location without a map. For banks, the digital landscape is vast and competitive, but the right SEO strategies can be the compass that guides customers directly to their doors. In the banking industry, where every click can lead to a significant financial decision, employing effective SEO strategies is not just beneficial; it’s essential.

Keyword Optimization

Keyword optimization underpins any SEO approach. Potential clients’ online search keywords must be identified and targeted by banks. These include “savings account” and “low-interest home loans in [Location].” Google’s Keyword Planner can reveal keyword search volumes and competitiveness. According to Backlinko, naturally including these keywords into website names, headers, and meta descriptions can increase a bank’s search ranks, making it simpler for potential customers to locate them.

Creating Engaging Content

Engaging content is the lifeblood of effective SEO. Banks should focus on creating informative and relevant content that resonates with their audience’s needs. This can include financial advice blogs, market analysis, or guides on different banking services. Content should not only be informative but also engaging and easy to understand. According to HubSpot, creating content that answers common customer queries can greatly improve a bank’s online visibility and authority. Additionally, regularly updating content keeps the website dynamic and more favorable in the eyes of search engines.

Mastering Local SEO

For many customers, banking is a local affair. Local SEO helps banks rank in local banking searches. This involves optimizing Google My Business profiles, getting listed in local directories, and ensuring NAP (Name, Address, Phone number) consistency across all platforms. Search Engine Watch highlights the importance of local SEO in driving foot traffic to physical bank branches, making it a crucial strategy for banks with a local presence.

These key SEO strategies for banks are not just tactics; they are fundamental elements that intertwine to form a robust digital presence. By focusing on keyword optimization, content creation, and local SEO, banks can not only improve their online visibility but also establish themselves as accessible, customer-centric institutions in the digital world. These strategies are the building blocks for constructing an online presence that not only reaches but resonates with the target audience.

Leveraging Mobile SEO and Responsive Design

In today’s world, where smartphones are as essential as wallets, responsive design and mobile SEO are not just trends; they are necessities for banks aiming to stay relevant and accessible. With more people using their mobile devices for everything from shopping to banking, ensuring a seamless mobile experience is critical.

The Rise of Mobile Browsing

The shift towards mobile browsing is undeniable. Statista reports that over half of the global web traffic comes from mobile devices. Banks must optimize their websites for smartphones to provide a good customer experience. This involves more than just making a site mobile-friendly; it’s about ensuring that every element, from text to images and call-to-action buttons, is easily navigable on a small screen. Mobile SEO goes beyond aesthetics; it’s about creating an efficient, user-friendly experience that meets the fast-paced demands of modern consumers.

Implementing Responsive Design

Successful mobile SEO relies on responsive design. It makes a bank’s website responsive to smartphones, tablets, and desktops. This adaptability improves user experience, which Google considers when ranking. Search Engine Land says responsive design increases usability and helps search engines crawl and index website material. This dual benefit makes responsive design a critical component for banks looking to improve their online presence and cater to the growing base of mobile users.

Banks must use mobile SEO and responsive design today. It’s about giving customers what they want, not merely adapting to technology. These factors allow banks to meet the expectations of modern, mobile-savvy customers by making their services easily accessible. This strategy is about being where customers are and providing an engaging and satisfying experience.

Building Authority with Quality SEO Content in Banking

In the banking industry, where trust is paramount, establishing authority through quality SEO content is not just effective—it’s essential. In a world overflowing with information, banks that provide clear, credible, and SEO-optimized content stand out. This strategy is more than just about attracting eyes with SEO; it’s about building lasting relationships based on trust, expertise, and effective SEO practices.

Blogging and Article Writing with SEO in Mind

Banks can establish themselves as thought leaders through consistent blogging and article writing optimized for SEO. This involves crafting well-researched and informative articles that address customer needs and industry trends while incorporating SEO strategies. A study by HubSpot reveals that companies with regular SEO-focused blogging see more traffic and higher conversion rates. For banks, this could mean SEO-optimized articles on financial planning, investment strategies, or navigating mortgage options. Each piece should not only provide value but also reflect the bank’s expertise in the field, leveraging SEO. It’s about turning a bank’s website into a go-to resource for financial wisdom and advice, enhanced with SEO.

Using Infographics and Visuals for SEO

In an age of visual information, SEO-optimized infographics and visuals are essential to content strategy. Infographics transform complex financial data and concepts into understandable and engaging visuals, contributing to SEO. According to Venngage, infographics can increase web traffic by up to 12%, partly due to their SEO value. Banks can use these tools, optimized for SEO, to illustrate market trends, explain banking processes, or provide financial tips. The key is to blend informational richness with eye-catching design, making complex information accessible at a glance and enhancing SEO.

Building authority through quality content, with a focus on SEO, is a strategic necessity for banks in the digital age. It’s about earning the trust and loyalty of customers by providing them with relevant, insightful, and visually appealing content, optimized for SEO. This approach not only enhances a bank’s SEO performance but also cements its reputation as a trusted advisor in the financial world. Quality content, rich in SEO, is more than words and images; it’s a powerful tool that banks can wield to build deeper connections with their audience, fostering trust that goes beyond transactions and is reflected in their SEO success.

Monitoring and Adapting to SEO Trends

SEO evolves, so staying static is like going backward. In the digital age, banks must adapt to SEO trends to stay relevant and lead in a competitive market. This dynamic SEO strategy helps banks evolve with the times and profit on future digital advancements.

Keeping Up with SEO Trends

Staying abreast of the latest SEO trends is crucial for banks to maintain their digital edge. This involves regular research and updates on search engine algorithms, emerging technologies, and customer online behaviors. Tools like Google Analytics and Moz offer insights into current trends and forecast future shifts. For instance, the growing importance of voice search and AI in SEO cannot be overlooked. A study by Gartner predicts that 30% of web browsing will be voice-activated by 2023. For banks, this means optimizing for natural language queries and ensuring their content is easily accessible through voice search.

Adapting Strategies for Future Success

Adapting SEO strategies for future success involves not only embracing current trends but also predicting and preparing for future changes. This requires an agile and proactive SEO strategy that can swiftly adapt to new opportunities and difficulties. For example, the increasing focus on user experience as a ranking factor by Google means banks must ensure their websites are not just informative but also user-friendly and engaging. Integrating AI and machine learning for personalized customer experiences can also give banks a competitive edge.

Monitoring and adapting to SEO trends is a continuous and essential process for banks. It’s about being forward-thinking, agile, and customer-focused in their digital strategies. This proactive approach ensures that banks not only stay ahead in the SEO game but also effectively meet the evolving needs of their digital-savvy customers. Long-term success and relevance in digital marketing require speedy adaptation and evolution.

Conclusion

In wrapping up, SEO for banks is not just a strategy; it’s a journey towards digital excellence. As we’ve navigated through various aspects, from keyword optimization to adapting to SEO trends, it’s clear that a dynamic and informed approach is key to thriving in the digital banking landscape. Remember, the world of SEO is ever-changing, and staying updated is crucial. Curious about more insights and strategies? Dive into the Plerdy blog for a treasure trove of knowledge that will keep your bank ahead in the digital race. Remember, Plerdy can help you turn ideas into results-driven initiatives. Stay informed, stay ahead, and transform your bank’s digital presence with Plerdy.